US Dollar rally continues as Fed rate hike chances soar

- Back to all posts

- Latest

As many as five Federal Reserve members will be speaking in the US today, including Chair Janet Yellen who will be discussing economic outlook in Chicago at18:00 UK time. Vice Chair Stanley Fischer will also be making a public appearance in New York this afternoon. We expect policymakers to continue talking up the possibility of higher rates in the US with the Central Bank seemingly preparing the market for another interest rate hike later this month.

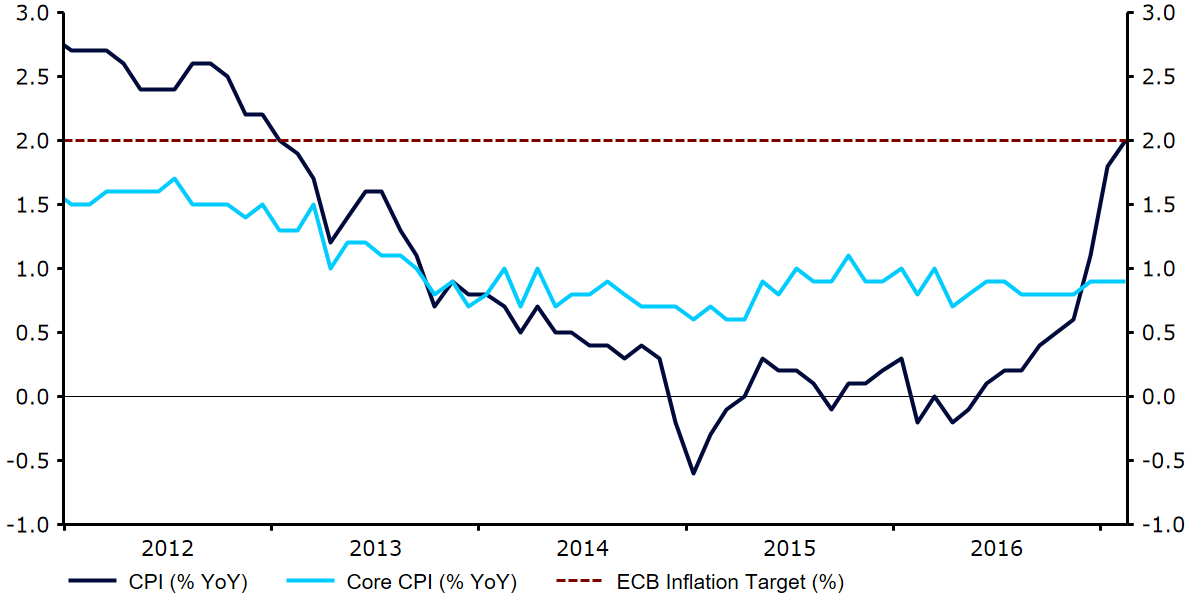

Political uncertainty and expectations for higher rates in the US continue to override the fairly impressive recovery in the Eurozone economy. Headline inflation in the Euro-area finally returned back above the European Central Bank’s “close to, but below 2%” target in February according to yesterday’s preliminary data (Figure 1). However, with core inflation remaining stuck below 1% we think the Governing Council will continue to look through the recent uptick in price growth and remains unlikely to begin normalising monetary policy any time soon.

Figure 1: Eurozone Inflation Rate (2012 – 2017),

Meanwhile, Sterling touched a fresh six week low this morning after the release of a disappointing services PMI. The monthly PMI came in well below expectations at 53.3 compared to the 54.2 consensus, suggesting that the UK economy may be set to slow in the first quarter of the year.

Major currencies in detail

GBP

Thursday proved to be a fairly quiet day for the Pound, although the currency fell off by 0.3% this morning after the latest PMI miss.

Investors paid little attention to yesterday’s construction PMI, which is unsurprising given the sector accounts for less than 10% of overall economic output in the UK. The index unexpectedly rose to 52.5 in February from 52.2, although a slowdown in new orders and rising prices remain a concern for the industry.

The defeat in the House of Lords on Theresa May’s Brexit bill should only prove a minor setback to her plans to trigger Article 50 before the end of March, although the general increase in uncertainty has kept Sterling gains to a minimum.

EUR

Expectations for higher rates in the US caused the Euro to end trading 0.25% lower against the US Dollar yesterday, despite the impressive rebound in inflation in the Euro-area.

Eurozone inflation hit its highest level in more than four years last month in a welcome sign that the European Central Bank’s large scale easing measures was finally beginning to push prices higher in the currency bloc. The jump in the headline measure was largely due to an increase in food and energy prices with core inflation, which excludes these volatile priced products, remaining unchanged at a fairly lowly 0.9%.

Despite the recent impressive performance in the Eurozone economy, we expect ECB President Mario Draghi to reiterate the need for a loose monetary policy stance when the central bank meets next week.

The monthly services PMI’s will be released in Europe this morning with the main Euro-wide index expected to remain unrevised from its initial flash estimate. Retail sales will also be worth looking out for at 10:00 UK time.

USD

The US Dollar index hit a fresh seven week high, rising 0.3% on Thursday as investors continue to ramp up expectations of a rate hike by the Fed in March.

News out of the US labour market yesterday continued to support the idea of higher rates in the country with initial jobless claims falling to a fresh multi decade low. Claims last week declined to 223,000 from 242,000, its lowest reading in nearly 44 years and comfortably below expectations. The four-week moving average, a far more representative gauge of overall labour market strength, also decreased to 234,250, its lowest level since 1973.

Yellen’s speech this afternoon will be the main focal point in the US today. The first Friday of the month payrolls report will not be released until next week.