US Dollar under pressure from Hillary Clinton email controversy

- Back to all posts

- Latest

The US Dollar sank against its major peers on Monday afternoon, with growing uncertainty over the result of next week’s Presidential Election causing the currency to fall.

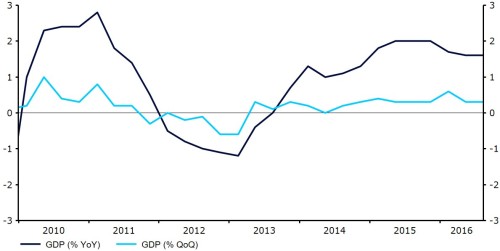

The Euro received little help from Monday’s morning’s GDP and inflation numbers in the Eurozone, which came in right in line with expectations. The Eurozone economy grew by 1.6% in the year to the third quarter (Figure 1).

Figure 1: Eurozone Annual GDP Growth Rate (2010 – 2016)

Meanwhile, the Bank of Japan kept its monetary policy unchanged overnight. The central bank once again delayed its timetable for reaching its inflation target, while stating that it would keep its policy unchanged unless a severe shock affected the Japanese economy’s recovery.

This week will be an exceptionally busy one in the currency markets, with plenty of economic releases and central bank announcements, not to mention the build-up to next week’s US Presidential Election.

The Federal Reserve will be announcing its interest rate decision and releasing the minutes of its November monetary policy meeting on Wednesday evening. While we think that it is entirely possible that the Fed could hike this week, we think that the central bank will hold off until after the Presidential Election. The key for the US Dollar will be the tone of the statement and number of dissenters voting for an immediate hike.

Thursday’s Bank of England meeting and Friday’s US labour report will round off a hectic few days for the major currencies.

Major currencies in detail:

GBP

The Pound rose 0.4% yesterday, largely driven by a weak US Dollar.

Attention in the UK will be firmly on the Bank of England this week, although Thursday’s monetary policy meeting could go under the radar somewhat given events elsewhere. We expect rates to be kept unchanged, with last week’s strong GDP numbers and a very fragile Pound lowering the risk of a cut.

The BoE announced yesterday that Governor Mark Carney will be stepping down from his position at the end of June 2019, with Carney extending his term by an additional year beyond his previous 2018 end date.

The manufacturing PMI from Markit will be released this morning, with consensus pointing to a slight drop off from September’s multi-month high reading. Investors will, however, be focusing heavily on Thursday’s Bank of England meeting.

EUR

A mixed session for the Euro ended with the currency 0.1% higher against the Dollar.

Yesterday proved to be a busy day of economic data in the Eurozone, although the announcements had little material impact on the single currency. The Euro-area economy grew by a steady, if not spectacular, 0.3% in the three months to September, matching the same level of growth recorded in the second quarter of the year. The Eurozone’s economy has now grown by less than two percent on an annual basis for each of the past three quarters.

Inflation in the Eurozone also came in at 0.5%, a modest uptick from the 0.4% recorded in September. Core inflation remained unchanged and below one percent at 0.8% on a year previous.

With no economic data out of the Eurozone today, the Euro is likely to tread water until Wednesday evening’s Federal Reserve meeting.

USD

The Dollar slumped during afternoon trading to end 0.2% lower against its major peers.

In terms of economic news yesterday, consumer spending for September beat expectations. Spending grew at a very healthy 0.5%, having contracted a month prior. Personal income picked up to 0.3% but it was still less than markets expected.

Manufacturing activity in the Chicago region also slowed significantly, adding to growing concerns over the health of the sector.

Wednesday evening’s FOMC meeting will be the main event risk in the currency markets this week. In the meantime, manufacturing data from ISM could prove a market mover this afternoon.

Receive these market updates via email