US Dollar firms after Presidential Election TV debate, Sterling sinks again

- Back to all posts

- Latest

The US Dollar was broadly stronger as currency markets opened in London on Monday following Sunday night’s US Presidential Election TV debate.

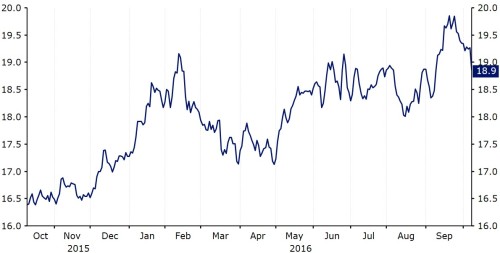

In a clear sign that markets are beginning to completely discount the possibility of a Trump election victory, Monday’s largest gainer was comfortably the Mexican Peso, which soared over 2% against the Dollar. The Peso, which had been under heavy pressure when Trump surged in the polls, has now recovered over 5% of its value since the first TV debate in September (Figure 1).

Figure 1: USD/MXN (October ‘15 – October ‘16)

Fivethirtyeight.com, a US opinion poll website that generates probabilities on the outcome of the election, has shown a growing divergence in the polls between the two Presidential candidates since the first TV debate. This now places over an 80% probability that Clinton will come out on top when Americans go the polls on the 8th of November.

Meanwhile, Sterling fell sharply overnight, with the currency unable to shake off concerns surrounding Britain impending exit from the European Union. Speculator bets against the Pound reached an all-time high in the week ending the 4th of October, suggesting that further weakness in the currency could be on the horizon following last week’s ‘flash crash’.

Attention this week now undoubtedly turns to Wednesday evening’s Federal Reserve meeting minutes. Any additional hints of a US interest rate hike before the end of the year would provide further impetus for a US Dollar rally this week.

Major currencies in detail:

GBP

Sterling dipped 0.7% against the Dollar yesterday. The currency has now lost almost 5% of its value since the beginning of October alone, as concerns over Britain’s EU exit continue to dominate headlines.

While the UK economy has so far held up relatively well following the Brexit vote, a report released by the British Chambers of Commerce on Monday showed that domestic businesses face an uncertain future post-Brexit. Measures of business investment and turnover confidence hit four-year lows in the third quarter, according to the survey.

With investors continuing to almost completely overlook economic data in favour of political developments, we think that domestic announcements will likely take on less importance in the UK this week.

EUR

The single currency dipped 0.6% versus the US Dollar on Monday, although continues to trade within one of the narrowest bands we’ve seen in awhile.

Investors overlooked economic data out of the Euro-area on Monday, despite it being mostly positive. Investor sentiment, as measured by Sentix, rose above expectations in October, with the monthly index rising to 8.5 from 5.6. Germany’s trade surplus also ballooned to €22.2 billion following a sharp increase in exports and a relatively mild rise in imports.

The FOMC’s meeting minutes on Wednesday evening provide the biggest event risk for the Euro in an otherwise light week of economic releases. The monthly ZEW business sentiment indexes this morning could shift the single currency if we see any significant divergence from consensus.

USD

The US Dollar rose 0.5% against its major peers despite a lack of announcements out of the US due to Columbus Day.

With no major economic releases for the second day today, all eyes will turn to tomorrow evening’s Federal Reserve meeting minutes. The Fed is expected to shed light on the likelihood of an interest rate hike at the coming two meetings with most analysts, ourselves included, now eying up the Fed’s December meeting as the likely timing of the next rate increase.

Fed Chair Janet Yellen will also be making an appearance in Boston on Friday when she speaks at a macroeconomic conference, while retail sales on Friday are forecast to show a welcome improvement in September.

Receive these market updates via email