The US Dollar rebounded against its major peers on Monday, having experienced a dire few weeks that has seen the currency suffer from one of its worst quarterly performances in seven years.

Financial markets will be closed in the US today in mark of Independence Day. We now await the Federal Reserve’s meeting minutes on Wednesday and the latest nonfarm payrolls number on Friday. Consensus is for a figure around the 180,000 mark which should be more than enough in our view to ensure the market continues to price in another interest rate hike by the Fed in 2017.

UK manufacturing slows, Inflation Report hearings today

Sterling dipped back below the physiological 1.30 level against the US Dollar as markets opened for the week with a contrasting set of manufacturing news reigniting concerns about a slowdown in economic activity in the UK.

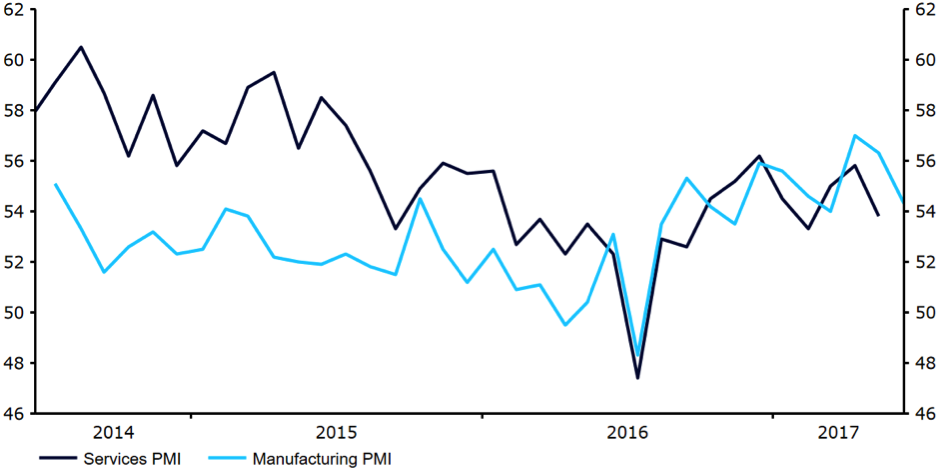

The latest manufacturing PMI from Markit showed that factory activity grew a lot slower than expected last month. The index fell to 54.3 from 56.3 (Figure 1), erasing much of last week’s gains in the Pound that saw the currency notch one of its best performances against the greenback in almost eight months.

Figure 1: UK PMIs (2014 – 2017)

Governor of the Bank of England Mark Carney continues on his relatively hectic schedule today when he presents the bank’s Inflation Report to the House of Commons this morning. The latest construction PMI at 9am will be a warm up for the much more significant services index on Wednesday that is expected to solidify the view that the UK economy picked up pace in the second quarter of the year.

Euro slips on Dollar recovery, mixed economic data

The common currency ended around half a percent lower for the day against the greenback on Monday, slipping from its highest level in over a year. Investors mostly overlooked economic news out of the Eurozone in favour of developments elsewhere. Unemployment came in unchanged at 9.3% versus the 9.2% consensus, while Markit’s manufacturing PMI was again encouraging, rising to a fresh six year high 57.4 from 57.3.

A host of economic releases in the Eurozone on Wednesday, including retail sales and the composite PMI will be the highlight of the week. In the meantime, senior ECB policymaker Peter Praet will be speaking in Rome this afternoon with markets primed for his view on the likelihood of a tightening in monetary policy before the end of the year.