Brexit uncertainty weighs on Sterling, UK inflation rises to five year high

- Back to all posts

- Latest

FX markets were relatively quiet as traders returned to their desks for the week on Monday, with little in the way of any significant news flow keeping the major currencies mostly range bound.

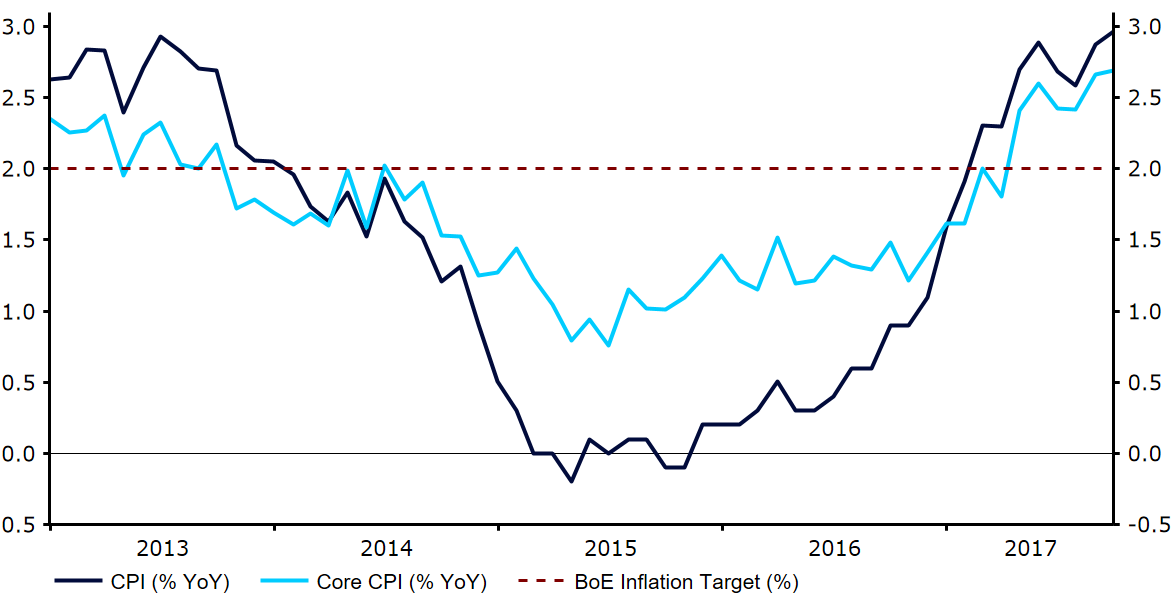

This morning’s inflation data was somewhat negative for Sterling, although not materially so as to influence the likely path of Bank of England policy. Headline consumer price growth accelerated as expected to 3% from 2.9%, its highest level since early 2012 (Figure 1). The core measure, which strips out volatile components, came in slightly below forecast although not enough so in our view to prevent the Bank of England from hiking interest rates for the first time in a decade in November.

Figure 1: UK Inflation Rate (2013 – 2017)

US Dollar firms as Yellen points to December hike

The US Dollar firmed on Monday, having sold-off relatively sharply on Friday following the disappointing inflation news which showed that consumer price growth was fairly benign in September. Yesterday’s solid performance in the US currency was largely due to position squaring, while comments from Chair of the Federal Reserve Janet Yellen on Sunday reaffirmed the central bank’s intention to raise interest rates again in December.

Yellen claimed that the US economy remains strong, with the strength of the labour market warranting gradual increases in interest rates. The central bank chief reiterated it will be “paying close attention to the inflation data in the months ahead”, although she said that the recent soft readings in price growth were not likely to persist. Following recent hawkish communications, the market is now pricing in around an 80% chance of another rate hike in December. We’re likely to get a firmer indication as to the possibility of another 2017 rate increase when policy makers next meet on 22 November.

Activity should pick up pace in the US today with a number of second tier economic data releases likely to shift the greenback. Industrial production data and a speech from FOMC member Harker will be the main focal points.

Catalan leader fails to clarify independence call

All eyes in Europe were on Catalonia yesterday. In a letter to Madrid, Catalonia President Carles Puigdemont called for negotiation over the next two months, although it remains unclear whether his administration had officially declared independence from Spain. If Madrid ignores Catalan’s case for greater autonomy then the region will only have until Thursday to withdraw its secessionist bid or face being put under Spanish rule.

This morning’s Eurozone inflation data presents the next major event risk for the common currency, although no revision to the September numbers are expected when released at 11:00 UK time.