Sterling pops, Dollar drops as Carney hints at interest rate hike

- Back to all posts

- Latest

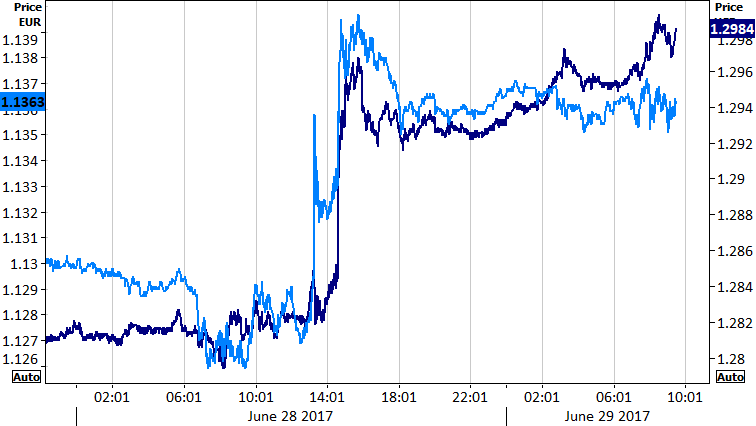

The Pound soared by around one percent against the US Dollar on Wednesday after comments from Governor of the Bank of England Mark Carney suggested that higher interest rates in the UK could be imminent (Figure 1).

Figure 1: GBP/USD & GBP/EUR (28/06/2017 – 29/06/2017)

We have been saying for a number of weeks now that the market is under-pricing the possibility of higher rates in the UK this year, particularly given inflation is approaching 3% for the first time since 2013. We think there is a very reasonable chance additional members of the bank’s MPC could join both Ian McCafferty and Michael Saunders in voting for higher rates before the end of the year, particularly should the upward trend in price growth continue.

Economic news out of the UK today is fairly light on the ground, with lending data not likely to rock the boat. Sterling is likely to instead be driven by events elsewhere, namely this afternoon’s GDP data out of the US.

Draghi comments misjudged claim ECB sources

Wednesday was a particularly volatile day again for the Euro. The currency sank by over half a percent against the US Dollar in a matter of seconds just after midday following the release of a report suggesting that the sharp appreciation in the Euro on Tuesday was overdone.

The market reacted in an overwhelmingly positive fashion to comments from ECB President Mario Draghi that implied a tapering in the central bank’s QE programme could be on the way. However, yesterday’s report appeared to backtrack on his hawkish rhetoric, instead claiming that Draghi intended to prepare markets for stimulus, rather than making a firm commitment to it.

The sell-off itself proved short-lived, with the single currency marching upwards to its strongest position since May 2016 this morning. As we have mentioned recently, the likelihood of a dialling back in the ECB’s stimulus programme is almost certain to be the main driver in the Euro during the remainder of 2017.

Dollar languishes around nine month lows ahead of GDP data

The Dollar has taken a hammering so far this week, largely off the back of broad Euro strength. Wednesday’s pending home sales also provided little relief from the sell-off. Sales in May declined unexpected by 0.8% as a supply crisis in the sector continues to worsen. Investors will now look to GDP and inflation data today and tomorrow. Federal Reserve member James Bullard will also be speaking this evening.

A major benefactor of USD weakness has been the Canadian Dollar, which was just about the best performing currency in the world yesterday. The currency soared off the back of hawkish comments from the Bank of Canada’s chief Stephen Poloz that hinted at a slightly less accommodative stance.