US Dollar slumps after FOMC, Euro hits fresh two year high

- Back to all posts

- Latest

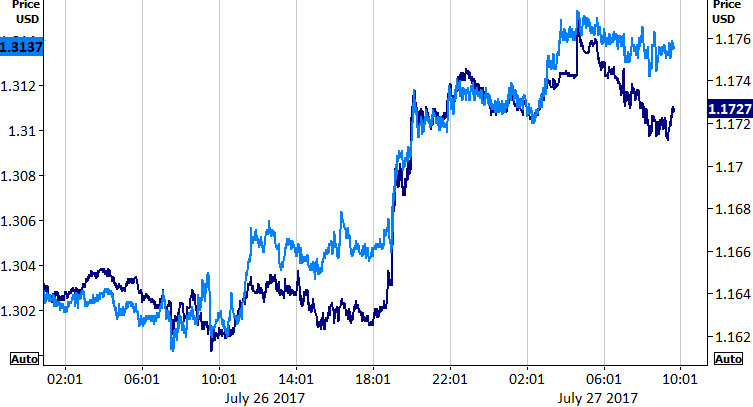

The US Dollar depreciated against both the Euro and Sterling following the Federal Reserve meeting on Wednesday evening.

Figure 1: EUR/USD & GBP/USD (26/07/17 – 27/07/17)

As expected the Fed used its statement to signal that it will soon announce the start of a balance sheet normalisation, having accumulated a vast volume of assets during its quantitative easing programme. We now expect this announcement to come as soon as the September meeting. However, the Fed changed its rhetoric on inflation, claiming that the headline rate was now running “below” 2% compared to the “somewhat below” that was included in the previous statement in June. Currency markets latched onto this dovish shift, pushing back expectations for the next interest rate hike and heavily selling off the US Dollar. While markets are now discounting another hike in 2017 we still expect to see another 25 basis point increase in December.

Fallout from yesterday evening’s meeting will be the main driver in the currency markets today, absent any political surprises. This afternoon’s durable goods order data could prove a market mover when released at 13:30 UK time.

UK growth picks up pace as film production does

The Pound edged marginally higher against the US Dollar before yesterday’s FOMC meeting, before powering through the 1.31 level to its highest level since September during New York trading.

Sterling received modest support earlier in the day from the news that growth in the UK economy picked up pace in the second quarter of the year, albeit barely. Growth in the UK rose to just 0.3% in the three months to June, modestly higher than the meagre 0.2% recorded in the first quarter. A sharp jump in film production in the UK, including box office receipts from cinemas, proved a fairly significant contributor to the rise in output and accounted for around one-quarter of the increase. Regardless, 0.3% quarterly expansion is far from desirable levels and could cause the Bank of England to rein back on some of its more hawkish rhetoric when it meets next week.

The CBI’s trades survey this morning is unlikely to rock the boat. Traders will instead have one eye on the aforementioned Bank of England meeting to see if any other central bank members join Ian McCafferty and Michael Saunders in voting for an immediate rate increase.

Euro jumps to fresh highs after Fed meeting

Amid a lack of market moving information the common currency traded within a relatively narrow band during London trading yesterday, although surged by around 1% after the FOMC meeting.

News out of the Eurozone was fairly sparse yesterday as investors awaited the announcement from the Federal Reserve. The common currency was little budged by European Central Bank member Nowotny’s comments late on Tuesday evening that reinforced the view that the removal of stimulus in the Eurozone would be gradual. Business confidence in Italy also rose in June with firms in the Euro-area seemingly undeterred by the prospect of an imminent removal in ECB stimulus and a weaker Euro. With no economic news of note whatsoever out of the Eurozone today the Euro is likely to be driven by expectations for Fed policy.