Euro slumps by most since Brexit vote after ECB extends QE programme

- Back to all posts

- Latest

The Euro fell sharply almost 2% against both Sterling and the US Dollar on Thursday, its largest decline versus the greenback since the Brexit vote, after the European Central Bank announced it would be extending its large scale quantitative easing programme.

The Governing Council will continue purchasing 80 billion Euros a month up until the end of March, although announced it will be lowering the monthly purchases to 60 billion Euros for the remainder of 2017. This increase in the ECB’s QE programme is significant in nature and will now see an extra 540 billion Euros pumped into the Eurozone economy.

President Mario Draghi also sent out a very dovish message in his press conference. Draghi insisted that the recalibration of the asset purchases did not constitute tapering (which would see the size of the programme wound down to zero), and was not even discussed by the Council.

The ECB’s general outlook was even more dovish. The ECB’s updated forecasts show that it is not expecting headline inflation to return to target until 2020 at the earliest and is discounting almost entirely the inflationary impact of rebounding commodity prices.

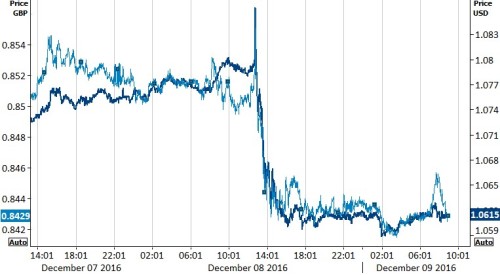

Currency traders reacted accordingly to Draghi’s comments, sending the Euro crashing sharply lower 1.5% against the US Dollar (Figure 1).

Figure 1: EUR/USD & EUR/GBP (07/12 – 09/12)

Draghi’s dovish surprise reinforces our opinion that the Euro is heading for parity with the US Dollar early next year, particularly given the Federal Reserve looks almost certain to hike interest rates for the second time in a year at its FOMC meeting next week.

Major currencies in detail

GBP

The Pound jumped almost 1% against the Euro, although edged slightly lower versus a broadly stronger US Dollar following yesterday’s ECB meeting.

The Supreme Court ended its four day hearing yesterday on parliaments appeal to trigger formal talks with the European Union. On Wednesday British lawmakers had backed Theresa May’s plans to trigger the start of formal talks with other European Union members on leaving the bloc by the end of March. However, this will depend on the outcome of the court hearing, due to be announced in January.

The Bank of England’s consumer inflation expectations and the monthly trade balance figures this morning will be the main economic releases today. Investors will tentatively turn their attention to next week’s Bank of England meeting.

EUR

Mario Draghi’s very dovish press conference yesterday sent the single currency sharply lower 1.5% against the US Dollar.

Following yesterday’s ECB meeting, we are even more confident in our call for EUR/USD parity next year, something we believe policymakers in Europe would not be opposed to. Mario Draghi acknowledged the improvements in the economy in the past few months, and the sell-off in the Euro between September and December are likely to have proved crucial to that recovery.

Moreover, the Euro is likely begin coming under intense pressure from the host of high profile political events next year. France, Germany, the Netherlands and now possibly even Italy will go to the polls in Presidential and general elections next year.

USD

The US Dollar index rose 1% yesterday after the ECB’s dovish surprise sent the Euro sharply lower for the day.

Initial jobless claims were completely overshadowed by Thursday’s ECB announcement. Claims came in at another very strong 258,000, right in line with expectations. Other than that, there was little economic news in the US.

Economic data will be fairly limited in the US today, with no major data releases of note. Investors will instead look to next Wednesday’s Federal Reserve meeting. Following Donald Trump’s election victory in November, financial markets have ramped up expectations for a interest rate hike in the US and now place a 100% implied probability that we’ll see one next week. The key will be the latest ‘dot plot’, which outlines expectations for further rate increases in the coming years.